Sustainable Investing

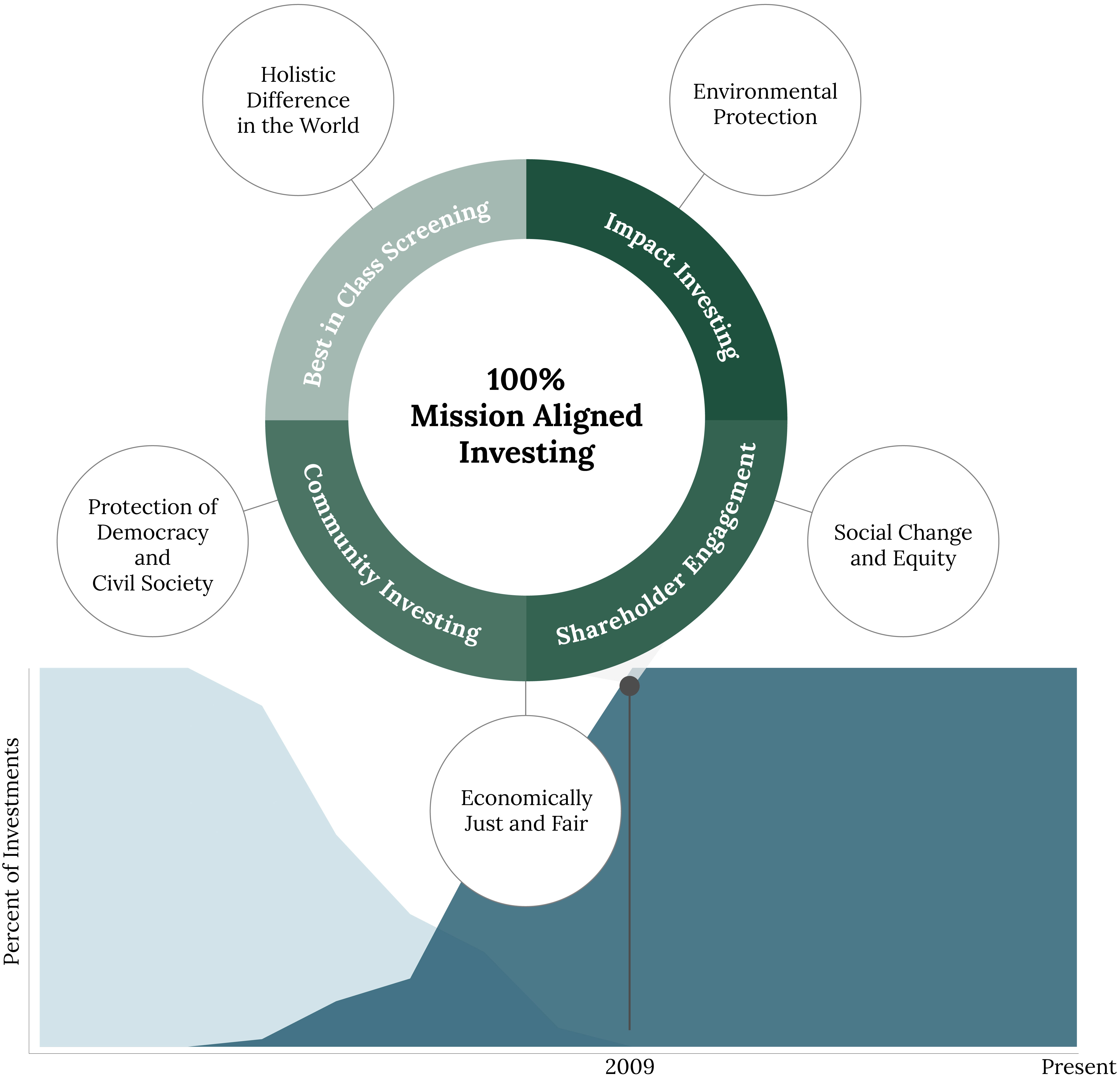

100% of investments align with the Park Foundation’s mission and grantmaking.

“

“The Park Foundation’s approach to making a difference in the world is holistic. Whether we are investing in social change or the market, we will remain mindful that money is a means, and not an end unto itself. As a foundation, our true bottom line is the good we do in the world. The very same values and ideals that guide our disbursement of funds to the programs that we support should also guide the management of our foundation’s capital assets.”

– Adelaide P. Gomer, President of Board of Trustees, Park Foundation

Park Foundation Sustainability Screening

Park Foundation screens each company on economic, social, and governance criteria to ensure they are suitable from a values and financial perspective. The sustainability criteria are critical from a portfolio management perspective. They help to identify strong management teams and company risks that allow for better decision making. The goal is to mitigate downside risk and allow for stronger performance over the long run. It's important to view the sustainability factors as opportunities to generate strong growth opportunities, which enable Park Foundation to deliver on its commitment to the community for generations to come. Our Investments consist of public equities, public bonds, private investments, and community investments.

Park Foundation is committed to 100% sustainable investing.

In 2006, we made our first mission-aligned investment. As we assessed its strong market performance that also lined up well with our values, we decided to transition our entire portfolio. The goal was to move 100% of our funds into alignment with our mission. To steward this transition, we searched for the best available investment advisors and chose RBC Wealth Management's SRI Team in San Francisco.

As a result, the Park portfolio became fully Environmental, Social, and Governance integrated, and impact-investment focused. The diversified asset allocation included public equities, fixed income, and alternative investments — with an eye, always, on long-term financial performance and the Foundation’s core values. From this grew an ESG Policy Statement that codifies the values and alignment with investments. The statement guides us as we screen prospective investments and promote other high-impact areas financial performance.

We retain a practiced team of experts to execute this vision. We emphasize the hiring of Black, Indigenous, and people of color (BIPOC) and women-led or owned firms in advocating diversity in the upper ranks of investment professionals and next-gen leaders.

Investment themes running through the portfolio include:

- Divestment from fossil fuel companies

- Clean energy and new resource economy

- Gender and racial equity, with a DEI focus on removing barriers that perpetuate the wealth gap

- Access to healthcare

- Strong corporate governance

- Water sustainability

- Community investments with a target on disadvantaged geographies and focus on low-income housing, nonprofits, education, healthy foods, and other community projects.

Park Foundation Portfolio Carbon Footprint (June 2017)

In 2017, the Foundation estimated the carbon footprint of its equity portfolio. The carbon footprint was calculated using the Scope 1 and Scope 2 emissions for each company, per company reported data or per Morgan Stanley Capital International (MSCI) estimations. The portion of the carbon footprint of a company attributed to the investment portfolio was proportional to the percentage of the company owned by the Foundation. A high portfolio carbon footprint relative to an appropriate benchmark can point to the presence of companies that generate significant greenhouse gases.

The Foundation’s carbon footprint of its investments was significantly less than a widely used market benchmark. According to an analysis conducted in April 2017, the carbon footprint of Park Foundation’s public equity holdings was approximately 12% of the MSCI ACWI Benchmark.The full report on the Foundation’s carbon footprint analysis is located at, Carbon Footprint Publication.

Submit a Proposal

Prior to submitting a proposal, prospective applicants should contact the Foundation to determine appropriate fit. Please be prepared to provide information regarding content and treatment, distribution, outreach, budget, funding sources (and fiscal sponsorship as appropriate).